- Our Services

- About Us

- FAQs

- Resources

- In the News

- Careers With Us

- Contact

- Signup

- Self-Managed Super Funds

Putting recent share market falls in context

Putting recent share market falls in context

Introduction

Uncertainties regarding the emerging world and specifically China and the US Federal Reserve’s much talked about first interest rate hike have continued to result in volatile share markets over the last few weeks even though most have not made new lows for this downturn. From their highs earlier this year to their recent lows, which were mostly a few weeks ago, major share markets have had the following falls: Chinese shares -43%, Asian shares (ex Japan) -23%, emerging markets -22%, Eurozone shares -18%, Australian shares -16%, Japanese shares -16% and US shares -12%.

I feel more comfortable when shares are rising than falling as it’s a positive sign for economic growth, long term prosperity and of course individual wealth. But I also know that periods of decline and volatility are a necessary part of the way the share market works. This note takes a look at past significant share market falls as they help put the current weakness in context.

Recent falls in context

We’ll start with the US, as while other markets are important at times, the US remains the world’s biggest and most watched share market and it invariably sets the big picture swings in most other major markets. The next table shows 10% plus falls in US shares since the end of the 1980s.

Much of the debate around share market declines concerns whether they are a correction or a bear market. Unfortunately there is no agreed definition of a correction versus a bear market – and certainly no “official” who makes declarations on this. My preferred approach is that a correction is limited to sharp falls, up to 20% or so, across a few months after which the rising trend in share prices resumes, taking shares back to new highs within say six months of the low. By contrast, a bear market sees falls lasting many months or years and it takes shares more than a year to gain new highs. Following this definition bear markets are highlighted in bold, corrections in blue. Falls less than 10% are not shown as they occur too frequently to be of interest.

Bear markets highlighted in black. Source: Bloomberg, AMP Capital.

Excluding this year, since 1989 the US share market has experienced 10 falls of 10% or more. Of these, only the 49% fall between March 2000 & October 2002 and the 57% fall between October 2007 and March 2009 were bear markets, whereas those in 1990, 1997, 1998, 1999, 2010, 2011 and 2012 were corrections as a rising trend quickly resumed. Since December 1988 US shares have returned 10.3% pa (including dividends).

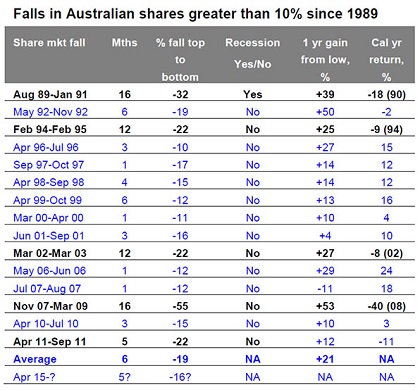

The next table shows the same analysis for Australian shares.

Bear markets highlighted in black. Source: Bloomberg, AMP Capital.

Over the same period, the Australian share market has returned 9.3% and has had 15 falls greater than 10% (excluding that seen this year). Of these five were bear markets according to our definition.

Observations

There are several points to note about all this:

-

Falls of 10% or more are not unusual. Most of these occur within a still rising trend which is re-established reasonably quickly. Only a small proportion become bear markets. Australian shares had a decent (10% plus) correction in every year from 1996 to 2001 and yet made new highs within 6 months each time and each year saw shares deliver a positive return. In fact most of the years which saw corrections as highlighted in the above tables saw positive calendar year total returns (ie, capital growth plus dividends) – see the final columns.

-

Short term corrections and bear markets don’t equate to poor longer term returns from shares. Since December 1988 US shares have returned 10.3% pa and Australian shares 9.3% pa despite numerous corrections and bear markets. So while shares are highly volatile over short term periods their returns are more consistent and solid over long run periods. This can be seen in the next chart comparing annualised returns on Australian shares over rolling 12 month and 20 year periods. Whereas the rolling 12 month return bounces around violently, the rolling 20 year return is relatively stable.

Source: Global Financial Data, AMP Capital

-

While it is reasonable to worry that recent share falls might be a warning of an approaching economic slump, the track record of share markets in foreshadowing recessions is not good. Of the ten share market falls in excess of 10% in the in the US noted above (excluding the present) only three were associated with recessions. Similarly in Australia of the 15 share market falls greater than 10% or more in the table above only one was associated with a recession. Hence Paul Samuelson’s quote that “Wall Street indexes predicted 9 of the last five recessions.”

-

Recessions do make a difference, particularly in the US where share market falls associated with recessions averaged 42% versus an average of 14% for those that do not. And of course Australia’s deepest share market fall in the last 25 years or so, ie the 55% plunge over November 2007 to March 2009, was associated with a US recession.

-

Once share market falls run their course they are usually followed by a strong rebound in the subsequent 12 months. This is evident in the second last column of the tables above which shows capital growth in the 12 months following the share market lows.

-

Finally, while it is natural for investors to prefer rising share markets than falling, periods of decline and volatility are a necessary part of the way the share market works given the investor psychology that plays a huge role in pushing the share market to extremes at times relative to its long term rising trend. Essentially, periods of share market weakness stop investors from getting too euphoric, they provide a reminder that the outlook is not risk free and they help reset starting point values to provide a reasonable medium term return potential after periods when returns have run above average. In terms of the latter, the recent decline in share markets has pushed up the medium term (5 year) return potential from a diversified mix of assets from around 7% pa earlier this year to around 7.6% pa now. See the next chart. This is because when share prices are lower their return potential improves as dividends yields rise and shares trade on a lower price to earnings ratio. (Of course the return potential boost for a diversified mix of assets does not go up by more as the return potential from non-share asset classes are not or little affected by share market moves.)

Source: AMP Capital

Concluding comments

There are several implications for investors from all this:

First, while share market falls can be distressing they are a normal part of the way the share market works.

Second, share market falls are usually made worse by recessions (notably US recessions) and a combination of prior overvaluation, investor euphoria and significant monetary tightening. While current share market falls could still have further to go as China and Fed worries linger, fortunately the risk of a recession in the US is low at present and one should still be avoided in Australia and prior to recent share market falls we didn’t see the combination of overvaluation, euphoria and significant monetary tightening that invariably precedes major bear markets.

Finally, share market falls boost the medium term return potential from shares – simply because they make shares cheaper – and once share markets bottom they are invariably followed by a strong rebound. Trying to time the bottom though is always hard, so averaging in after falls makes sense for those looking to allocate cash to shares.

About the Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.