- Our Services

- About Us

- FAQs

- Resources

- In the News

- Careers With Us

- Contact

- Signup

- Self-Managed Super Funds

What are the 3 biggest living expenses for households?

What are the 3 biggest living expenses for households?

We check out the three largest contributors to household spending in Australia and where people would source additional cash if living expenses rose.

If you worked a full-time job in Australia in 1975, the average amount you would’ve earned a year was about $7,600, whereas today, that figure would be closer to $72,0001, according to research by McCrindle.

That’s welcome news, but while we’re earning more than what we did in 1975, things are also costing us more. A loaf of bread is 10 times the price, a litre of milk is three times the price, a newspaper is 20 times the price, not to mention petrol has doubled, with house prices in some capital cities up thirtyfold2.

We check out the largest contributors to household spending today and where people say they would source additional money if day-to-day expenses increased further.

Housing, food and transport

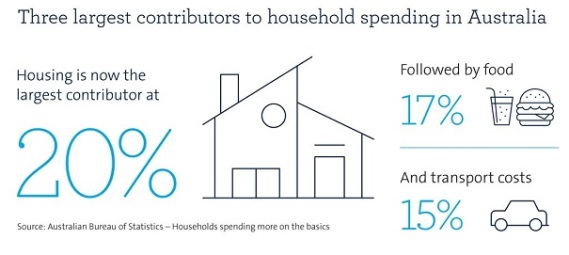

The three largest contributors to household spending in Australia have been the same for many years, according to the Australian Bureau of Statistics (ABS).

ABS figures reveal three-and-a-half decades ago the largest contributors to household spending were food (20%), transport (16%) and housing (13%), with housing now at the top of that list (20%), followed by food (17%) and transport (15%) respectively3.

A separate report by Deloitte highlighted that around 37% of Aussies were concerned about their ability to cover expenses, with more than 50% indicating that they expected to pay even more on housing and energy costs going forward4.

What people would do if costs rose further

When asked, if your day-to-day living expenses increased, where do you think you’d source additional money from, here was the top eight responses in a survey of Australians5:

-

Reduce luxury spending – 20%

-

Buy fewer groceries – 12%

-

Spend less on transport – 12%

-

Borrow money via a loan or credit card – 10%

-

Draw on savings – 5%

-

Spend less on food delivery and eating out – 5%

-

Cancel subscription services – 4%

-

Cancel streaming services – 3%.

Now that you’re aware that housing, food and transport are generally the biggest expenses for Aussie households, you may be looking at ways you could cut back and save in these areas.

If you seek further discussion please contact us on |PHONE| .

1, 2 McCrindle Research – 40 years of change: 1975 to today – table 2 and 3

3 Australian Bureau of Statistics – Households spending more on the basics – paragraph 5 and 6

4, 5 Deloitte Access Economics – ALDI household expenditure report – page 9 and 23

Important:

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, we do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, we do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person.

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for any action or any service provided by the author.

Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.