- Our Services

- About Us

- FAQs

- Resources

- In the News

- Careers With Us

- Contact

- Signup

- Self-Managed Super Funds

More volatile and constrained – the macro investment outlook for 2025

More volatile and constrained – the macro investment outlook for 2025

Key points

– 2024 was another strong year for investors with shares up strongly on the back of better than feared growth & profits and global central banks cutting rates. Volatility was low and balanced growth super funds returned around 11%.

– 2025 is likely to see positive returns but after the strong gains of the last two years, its likely to be more volatile and constrained, particularly as Trump returns with populist policies. A 15% plus correction is likely along the way.

– We expect the RBA to cut the cash rate to 3.6% with the first cut looking like it could be in February, the ASX to return around 7% and balanced super funds to return around 6%. Australian residential property prices are likely to soften further ahead of support from rate cuts.

– The key things to watch are: interest rates; recession risk; a likely trade war; China; and the Australian consumer.

Introduction

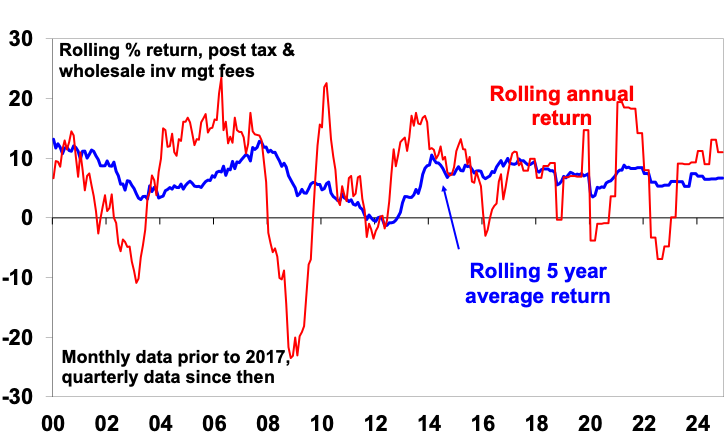

2024 saw another year of strong investment returns on the back of falling inflation, global rate cuts and growth and profits better than expected. US shares were particularly boosted by AI related enthusiasm and optimism that President elect Trump will boost the US economy with tax cuts and de-regulation. This saw average balanced growth superannuation funds return around 11% as shares and bonds had positive returns. Over the last five years, they returned 6.7% pa, which exceeded inflation.

Balanced growth superannuation fund returns

Source: Mercer Investment Consulting, Morningstar, Chant West, AMP

Here is a simple dot point summary of key insights & views on the outlook.

Five key themes from 2024

- Stronger than feared growth and profits. This was despite “high” interest rates, China worries and weak conditions in Europe.

- Global divergence. US growth was strong, Europe and Japan soft.

- Further disinflation. Inflation in major countries, including Australia, has fallen from peaks of 8 to 11% in 2022 to around 2 to 3%.

- Falling interest rates. The RBA lagged but should start early this year.

- Geopolitical threats failed to dent investment markets.

Five lessons for investors from 2024

- Monetary policy still works in controlling inflation, particularly if central bank credibility is high – the lags may be long and variable, and some are hit harder than others but there is nothing new here.

- Population growth and public spending matter a lot. Growth in both remained strong in Australia offsetting high rates in avoiding recession.

- Inflation matters more to voters than unemployment – as everyone is hit by the former but not the latter. This was evident in incumbent governments globally losing power in 2024.

- Timing markets is hard – it was easy to be gloomy with a long worry list but timing markets on the back of the worries was hard.

- Geopolitics is hard to predict and can be less impactful than feared, with the Middle East war not (yet) causing a surge in oil prices, despite lots of fear that it would.

Seven big worries for 2025 – expect more volatility

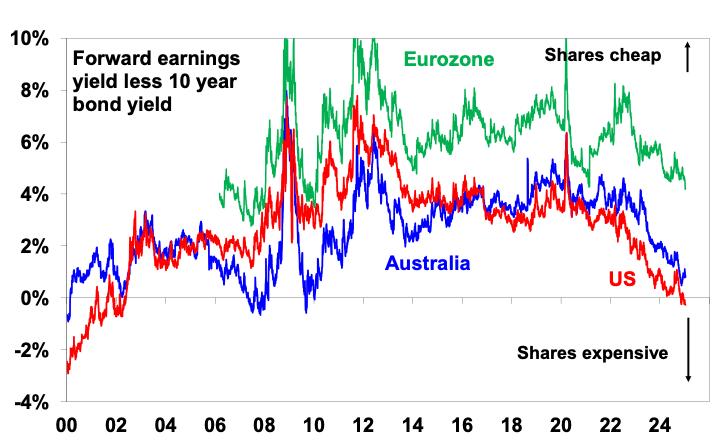

- Shares are expensive, with the key US share market trading on a 26 times forward PE and offering no earnings yield pick up over bonds. Australia is not so bad at 20 times but it’s not cheap either.

Equity risk premium over bonds

Source: Bloomberg, AMP

- Uncertainty remains around how much the Fed, the RBA and some other central banks will cut rates as core inflation is still not at target.

- Bond yields could continue to rise on the back of Trump’s tax cut and tariff policies, placing more pressure on shares.

- The risk of recession remains, particularly in the US if rising bond yields prevent a recovery in manufacturing and housing and in Australia if the RBA leaves rates too high for too long.

- A global trade war in response to Trump’s threatened tariffs could add to this risk particularly in Europe and Asia.

- Risks for the Chinese economy are high and could be amplified as Trump ramps up tariffs & if Chinese policy stimulus remains modest.

- Geopolitical risk is high: “maximum pressure” from Trump to resolve the war in Ukraine and Iran’s nuclear aims could see the Ukraine and Middle East wars getting worse before they get better threatening higher oil prices; tensions with China could escalate; political uncertainty is high in Europe with issues in France and Germany; but the Australian election is unlikely to lead to a radical change in policy.

These considerations point to a high risk of a significant share market correction at some point this year, particularly as Trump starts to ramp up tariffs as we saw in 2018.

Five reasons for optimism

- Inflation is likely to continue to trend down as labour markets are continuing to ease, demand growth is still slowing and commodity prices remain well down from their 2022 high.

- Central banks are likely to keep cutting rates. This is likely to range from the Fed likely cutting to 3.75-4% to the ECB which is likely to cut to 1.5%. This is likely to include the RBA where quarterly trimmed mean inflation is likely to have dropped to around 0.5-0.6%qoq in the December quarter (2.4% annualised or less), likely enabling it to start cutting in February. The recent fall in the $A being less severe on a trade weighted basis is unlikely to add much to inflation and so is unlikely to stop the RBA cutting, unless it falls a lot further.

- Global growth is likely to slow but only to just below 3%, with some strengthening in the second half helped by rate cuts. Australian growth is likely to edge up to 1.8% helped by rising real wages, tax cuts and rate cuts and this should see profit growth return.

- If recession does occur it’s likely to be mild as most countries have not seen a spending boom that needs to be unwound and traditionally makes recessions deep. And the Chinese government is likely to continue to do just enough to keep growth around the 5% level.

- Finally, while Trump’s policies on tariffs, will create a lot of uncertainty and disruption which could trigger a correction, his first term as President tells us he ultimately wants to see US shares up. He was also elected on a mandate to get the cost of living down for Americans, not push it up. This could ultimately mean more of a focus on tax and efficiency policies (which would be positive for shares) as opposed to tariffs. Similarly, bond market vigilantes and the 38 fiscally conservative House Republicans who voted against Trump’s debt ceiling extension will limit how much he can raise the budget deficit.

Key views on markets for 2025

- After the double digit returns of 2023 & 2024, global and Australian shares are expected to return a far more constrained 7% in the year ahead. Stretched valuations, the ongoing risk of recession, the likelihood of a global trade war and ongoing geopolitical issues will likely make for a volatile ride with a 15% plus correction somewhere along the way highly likely. But central banks still cutting rates with the RBA joining in, prospects for stronger growth later in the year supporting profits, and Trump’s policies ultimately supporting US shares, should still mean okay investment returns.

- Bonds are likely to provide returns around running yield or a bit more, as inflation slows to target, and central banks cut rates.

- Unlisted commercial property returns are likely to start to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

- Australian home prices are likely to see further near-term softness as high interest rates constrain demand. Lower rates should help from mid-year, and we see average home prices rising around 3% in 2025.

- Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow in the second half as the cash rate falls.

- The $A is vulnerable to more downside against the $US with a risk it falls below $US0.60 as the RBA cuts by more than the Fed, US tariffs support the $US and iron ore prices remain soft. Its more a strong $US story though than a weak $A story and so its fallen by much less on a trade weighted basis (down 5% since end 2023 versus down 10% against the $US) resulting in less of threat to inflation.

Six things to watch

- Interest rates – if underlying inflation fails to continue falling as we expect, central banks will be more hawkish than we are allowing for.

- Recession – a mild recession should be manageable, but a deep recession will mean significant downside in shares. So far global business conditions PMIs are consistent with okay growth.

- A trade war – Trump’s tariff policies risk igniting a global trade war which would be bad for global growth. Alternatively, if it’s a case of Trump “escalating to cut deals and then de-escalating” it may not be so bad, albeit after a rough patch along the way.

- The Chinese economy – China’s property sector is continuing to struggle, and more measures are needed to support consumers.

- Geopolitics – the big risk is an Israeli strike on Iran’s nuclear capability.

- The Australian consumer – consumer spending remains weak and could weaken further without interest rate cuts.

Five things the Australian election should be about

The last few years have seen a slump in living standards in Australia. Stagnant productivity has been a major driver and the election ideally should be about ways to reverse this. Key policies we need to see are:

- Tax reform to reduce the reliance on income tax and nuisance taxes.

- A cap on public spending to free resources for the private sector.

- Product and labour market deregulation to boost flexibility.

- More incentives to invest.

- Competition reforms to reduce market concentration.

Nine things investors should always remember

- Make the most of compound interest to grow wealth. Saving regularly in growth assets can grow wealth significantly over long periods. Using the “rule of 72”, it will take 16 years to double an asset’s value if it returns 4.5% pa (ie, 72/4.5) but only 9 yrs if the asset returns 8% pa.

-

Don’t get thrown off by the cycle. Falls in asset markets can throw investors off a well-considered strategy, destroying potential wealth.

-

Invest for the long-term. Given the difficulty in timing market moves, for most it’s best to get a long-term plan that suits your wealth, age and risk tolerance and stick to it.

-

Diversify. Don’t put all your eggs in one basket.

-

Turn down the noise. We are increasingly hit by irrelevant, low quality & conflicting information which boosts uncertainty. The key is to avoid the click bait, turn down the noise and stick to a long-term strategy

- Buy low, sell high. The cheaper you buy an asset, the higher its prospective return will likely be and vice versa.

-

Avoid the crowd at extremes. Don’t get sucked into euphoria or doom and gloom around an asset.

-

Focus on investments you understand offering sustainable cash flow. If it looks dodgy, hard to understand or has to be justified by odd valuations or lots of debt, then stay away. There is no free lunch!

- Seek advice. Investing can get complicated.

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.