- Our Services

- About Us

- FAQs

- Resources

- In the News

- Careers With Us

- Contact

- Signup

- Self-Managed Super Funds

Oliver's Insights

MBA Financial Strategists•Oliver's Insights

Oliver's Insights

2016 – a messy but okay year US share market analyst Joe Granville once observed that “if it’s obvious, it’s obviously wrong”. 2016 was perhaps remarkable for the things that many thought were obvious at the start of the year but did not happen: the global economy did not see plunging growth and deflation; the...Read More

Introduction After the recent experience with the Brexit vote in the UK and election of Donald Trump as President of the US which are indicative of a nationalist backlash against the pro-globalisation establishment, there is a fear that Europe will go the same way with nationalist forces in Italy, Austria, France, Germany, etc, triggering a...Read More

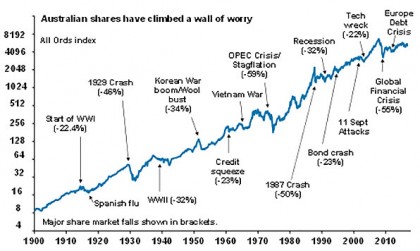

In the upside-down world logic that applies to much of investing, there are a bunch of mistakes investors often make which makes it harder for them to reach their financial goals. This note looks at the nine most common mistakes investors make. Mistake #1 Crowd support indicates safety “Bull markets are born on pessimism, grow...Read More

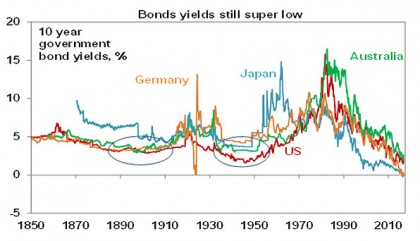

The end of the super cycle bull market in bonds?

November 16, 2016arc_admin

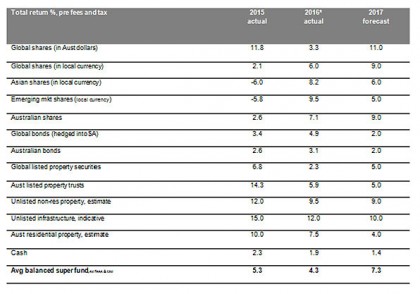

From record lows just after the Brexit vote – government bond yields have spiked higher. Ten year bond yields have risen from 1.36% in the US to 2.2%, from -0.19% in Germany to 0.31% and from 1.81% in Australia to 2.64% in four months. This in turn has led to sharp falls in high yield...Read More

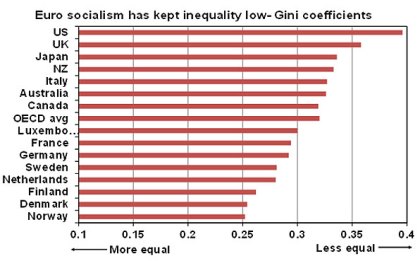

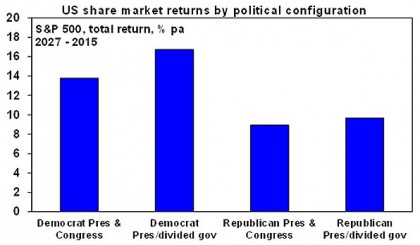

After a seemingly long and difficult campaign Donald Trump has been elected president of the United States with the Republican Party retaining control of the House, and the Senate, in Congress. Just as we saw with the Brexit vote, the combination of rising inequality, stagnant middle incomes and the disenchantment of white non-college educated males...Read More

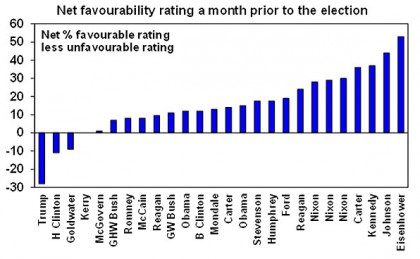

Perhaps the best that can be said of the US election is that it will soon be over. While polls had been moving in favour of a Clinton victory, the FBI’s announcement that it is examining new emails in relation to her use of a private email server while Secretary of State has taken it...Read More

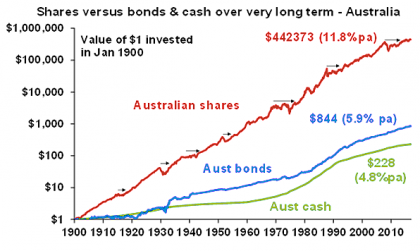

We are going through one of those periods where it seems there is a long list of things for investors to worry about: the US election; the Fed; ever present fears about a break of the Eurozone; and China. To be sure these risks are real and in our view some combination of them could...Read More

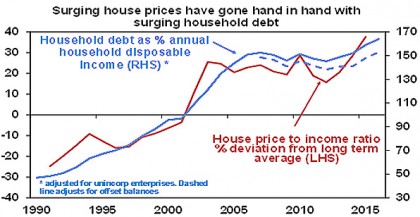

Housing matters a lot in Australia. Having a house on a quarter acre block is part of the “Aussie dream”. Housing is a popular investment destination. And the housing cycle is a key component of the economic cycle and closely connected to interest rate movements. But in the last 15 years or so it has...Read More

The US presidential election – Implications for investors

September 22, 2016arc_admin

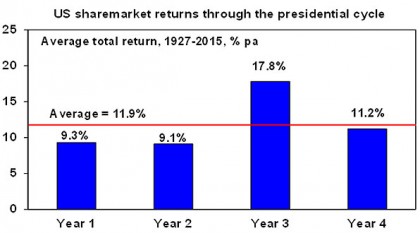

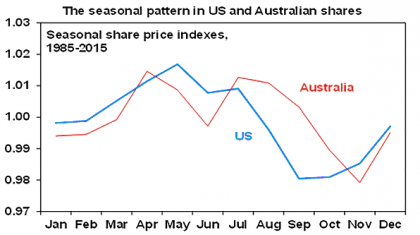

Donald Trump as the Republican candidate for president makes the outcome of the 8 November US presidential election of greater significance than normal. Many would see Trump’s divisive and demeaning comments about certain groups of people, short fuse and erratic nature as rendering him as unqualified to be US president. This note looks at the...Read More

After a period of relative calm share markets have seen a return to volatility lately. This has gone hand in hand with a back-up in bond yields. This note looks at the main drivers and how long this period of weakness may last. Why the falls? The weakness in share markets reflects a range of...Read More

News Source

Your privacy is important to us and AMP Financial Planning Pty Limited ABN 89 051 208 327 Australian Financial Services Licensee and Australian Credit Licensee No. 232706, which is part of Entireti. You may request access to your personal information at any time by calling us on (08) 8357 3999 or contacting Entireti on 1300 157 173. Information collected will be subject to Entireti's Privacy Policy. You can also contact us or Entireti if you do not wish to receive information about products, services or offers available from us or Entireti from time to time.