- Our Services

- About Us

- FAQs

- Resources

- In the News

- Careers With Us

- Contact

- Signup

- Self-Managed Super Funds

Oliver's Insights

MBA Financial Strategists•Oliver's Insights

Oliver's Insights

Megatrends impacting investment markets

July 28, 2016arc_admin

Introduction Recent developments – including the rise of populism, developments in the South China Sea and around commodity prices along with relentless technological innovation – have relevance for longer term trends likely to affect investors. So this note updates our analysis on longer term themes that will likely impact investment markets over the medium term,...Read More

Introduction The past few weeks have been messy with Brexit, the Australian election, another terrorist attack in France and an attempted coup in Turkey. In fact, the last 12 months have been – starting with the latest Greek tantrum and China share market plunge a year ago. It’s almost as if someone has listened to...Read More

Australia’s messy 2016 election

July 6, 2016arc_admin

Introduction This note takes a look at the implications of Australia’s Federal election. The Australian Federal election has delivered a messy result suggesting an even more difficult Senate for the Coalition if it is able to form government and the risk of return to minority government. The risk is that we will see a further slippage...Read More

Introduction In a shock for financial markets which had been increasingly confident that Britain would vote to Remain in the European Union, a victory for the Leave outcome by 52% to 48% triggered an abrupt bout of “risk off” in financial markets late last week. I suspect it was probably also a shock to many...Read More

Introduction What do the success of Donald Trump and Bernie Sanders in the US Presidential campaign, the close Brexit vote on Britain’s membership of the European Union and the Australian election have in common? They all signal some shift towards populism and support for more left wing policies in the electorate. If this trend flows...Read More

Introduction Y2K, Bird Flu, Peak Oil, Swine Flu, the end of the Mayan Calendar, Grexit, the fiscal cliff, US debt default, ghost cities, Ebola, Grexit again, imminent property crashes, etc…the world seems full of key events and phenomena upon which its whole existence – well at least the financial realm – supposedly hinges. Brexit seems...Read More

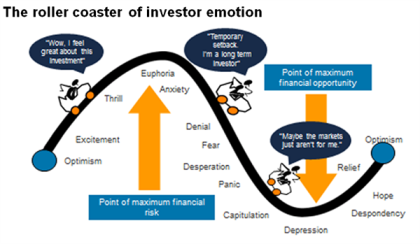

Introduction Recently I was asked where we are in the cycle of investor emotion between the extremes of “euphoria” and “depression”. This is a good question, as knowing where the investment crowd is at and being wary of it is essential to successful investing. The late 1980s Japanese bubble, the Asian miracle of the mid-1990s,...Read More

Introduction Since the global growth panic in January/February share markets and commodity prices have seen a decent rebound. and the stress in credit markets has receded. This has been helped by a combination of Fed assurances that it will not be reckless and ignore global risks in determining US interest rates, somewhat better economic data...Read More

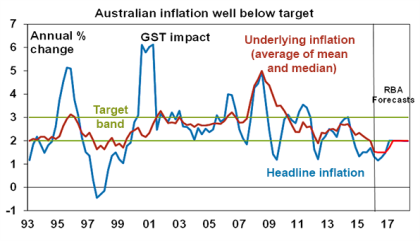

Introduction This year has seen a growing concern that central banks are out of ammo when it comes to reinvigorating global growth and preventing deflation. And the Reserve Bank of Australia’s latest rate cut has some fearing that it’s going down the same “failed path” as other major central banks. But is it really that...Read More

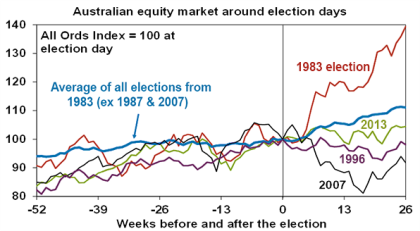

With the Federal election now confirmed for July 2 it is natural to wonder what the implications for investment markets and the economy might be. At present opinion polls give the Coalition a slight lead over Labor but it’s very close at around 51%/49%. That said according to bets placed on online betting agencies the...Read More

News Source

Your privacy is important to us and AMP Financial Planning Pty Limited ABN 89 051 208 327 Australian Financial Services Licensee and Australian Credit Licensee No. 232706, which is part of Entireti. You may request access to your personal information at any time by calling us on (08) 8357 3999 or contacting Entireti on 1300 157 173. Information collected will be subject to Entireti's Privacy Policy. You can also contact us or Entireti if you do not wish to receive information about products, services or offers available from us or Entireti from time to time.